tax saving strategies for high income earners canada

Contributions to these accounts dont reduce your taxable income for the year but distributions are tax-free. The tax laws limit the usefulness of this strategy for shifting unearned income to children under age 18 but some tax-saving opportunities still exist.

High Income Retirement How To Safely Earn 12 To 20 Income Streams On Your Savings Eifrig Jr Dr David 9780991513017 Amazon Com Books

Then again nobody.

. On the other hand contributions to a tax-exempt account are. After contributing 19000 to your tax-exempt 401k you are left with 81000 a year in gross income and. Poverty rate reduction by province 2015 and 2019.

This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. Full-year earners part-time earners and people with no earnings by educational attainment and age at arrival in the country. Earning 100000 is not considered rich either.

Best time of the year to retire for tax purposes When you retire can potentially have a big impact on your retirement income and the taxes you owe. Opportunity for All Canadas First Poverty Reduction Strategy set 2 key poverty reduction targets. Statistics Canada Canadian Income Survey.

This rate is lower than the personal income tax rate. Time Use by Country Income Level. One allowable tax deduction that can also be a significant long-term wealth creation strategy is maximising your voluntary superannuation contributions.

If those funds are withdrawn in five years when the person is in a higher tax bracket and pays a 32 income tax 320 will be paid out. That means high earners may be better off contributing to the traditional 401k and taking the tax deduction now at their high marginal tax rate than saving in a Roth account. You are considered middle class to lower middle class in expensive coastal cities.

An early governmental measure that slightly reduced. In middle income countries youth are more likely to be students wage employed or NEET in low income countries youth are more likely to be self-employed or underemployed. 3 min read Aug 25 2022.

A conclusion you could come to in that graph for MFJ is that if you have above average SS and a material amount of other income such as RMDs if you hit the hump 405 range at all it is for a. Income inequality has fluctuated considerably since measurements began around 1915 declining between peaks in the 1920s and 2007 CBO data or 2012 Piketty Saez Zucman dataInequality steadily increased from around 1979 to 2007 with a small reduction through 2016 followed by an increase from 2016 to 2018. Control the tax year for income and deductions Although do it now is excellent advice in nearly every situation when it comes to taxes there can be a benefit to carefully considering the.

Is Earning 100000 Considered Rich. Regional trends 22 Infographic. A 20 reduction in poverty by 2020 and a 50 reduction in poverty by 2030 relative to 2015 levels.

Combined income includes your adjusted gross income tax-exempt interest income and half of your Social Security benefits. 100000 is considered upper middle class in lower cost areas of the country. Youll save more in taxes with a Roth 401k if youre in the same or a.

You can currently.

Worthwhile Canadian Initiative The Gender Politics Of Taxation

Liberals To Go Further Targeting High Income Earners With Budget S New Minimum Income Tax Saltwire

High Income Earners Need Specialized Advice Investment Executive

How To Reduce Your Taxable Income 2022

Tax Strategies For High Income Earners 2022 Youtube

Tax Strategies For High Income Earners 2022 Youtube

In 1 Chart How Much The Rich Pay In Taxes The Heritage Foundation

High Income Retirement How To Safely Earn 12 To 20 Income Streams On Your Savings Eifrig Jr Dr David 9780991513017 Amazon Com Books

How To Crush Your Rrsp Contributions Next Year Financial Independence Hub

Wendy Chung Rami Aziz Wealth Management Tfsa Vs Rrsp Or Both

Progressive Tax Definition Taxedu Tax Foundation

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

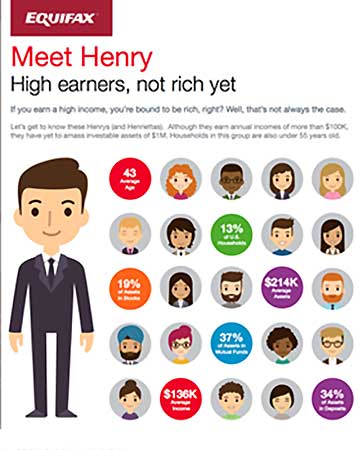

Meet Henry High Earners Infographic Equifax

Greens Urge Buffett Rule To Get More Tax From High Income Earners

High Income Retirement How To Safely Earn 12 To 20 Income Streams On Your Savings Eifrig Jr Dr David 9780991513017 Amazon Com Books

Personal Income Tax Brackets Ontario 2021 Md Tax

High Income Canadians Data On How Much They Earn Pay In Taxes Income Inequality And What It Means To Be A One Percenter In Different Cities Provinces Across The Country R Personalfinancecanada